Charitable giving can be done in many thoughtful ways, and for the Columbus in Motion Campaign, gifts may be pledged, and payments spread over a period of up to 5 years. Here are a few examples of gifts that may suit your philanthropy planning:

Checks, Cash or Credit Card

These are the most common gifts made. Your gift will be deductible at its full value on your income tax return if you itemize your deductions; up to 60% of your adjusted gross income (tax deduction can be spread over multiple years and carried forward to future tax years if limitations exist; consult your tax advisor).

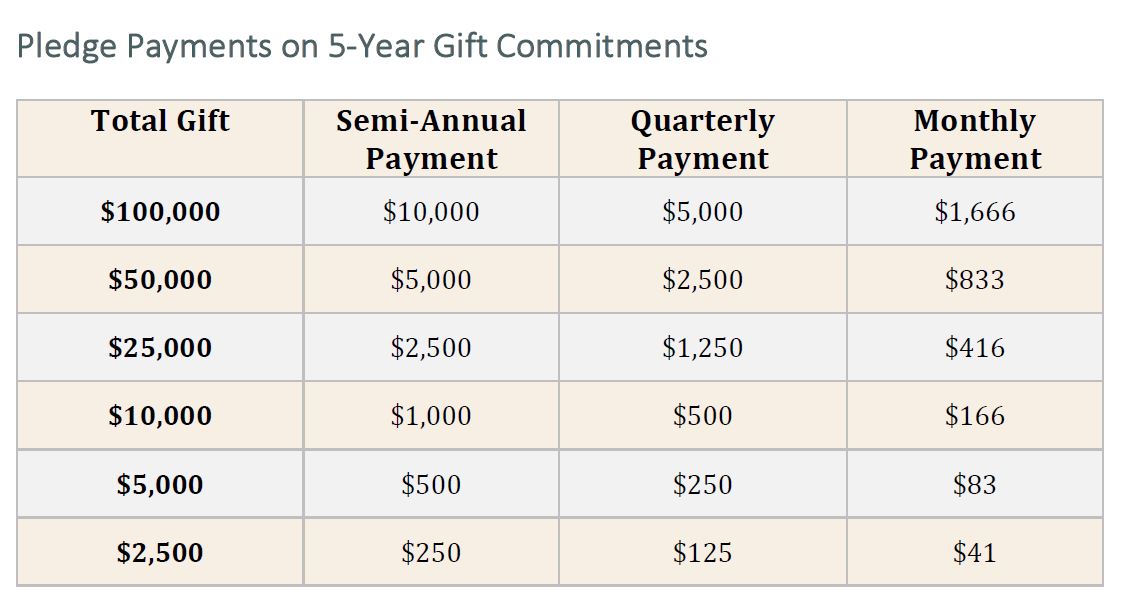

Multiply your impact by pledging

Thanks to our partnership with Forward Bank, we are able to take pledges over five years. This has the potential to impact your gift in a couple of different ways. If you already made a one-time donation, please consider if you can do the same donation for another four years. If so, reach out to us for a (new) pledge form so we can give you the proper recognition, and see if you qualify for any naming rights opportunities! Or, perhaps you are interested in a certain giving level but can't do it all at once. If that is the case, pledging may make it possible for you.

Publicly Traded Stocks

These are easy to give and can offer you great tax advantages. If you have held the stock for more than 1 year and it has appreciated in value, you can make a gift of publicly traded stock to the campaign and avoid paying capital gains tax on the transaction. Your broker can make the transaction electronically, upon your authorization.

Qualified Retirement Assets

Your retirement fund can be taxed at a high rate if passed on to heirs but can pass to charities without taxation. Leaving your remaining retirement assets to the campaign as part of your estate planning is a very simple gift to make. Of note, if you wish to contribute from your IRA during your lifetime and you are age 70 ½ or older, you can contribute up to $100,000 directly from your IRA and avoid paying income taxes on the distribution (again, consult your tax advisor).

To Make a Donation

Contact our Development Department

715-387-1177

giving@columbusdons.org